Feasibility Analysis

What is Feasibility Analysis??

- An analysisand evaluation of a proposed project to determine if it (1) is technically feasible, (2) is feasible within the estimated cost, and (3) will be profitable for Organization.

- Feasibility analysis guides the organization in determining whether to proceed with the project.

- Feasibility analysis also identifies the important risks associated with the project that must be managed if the project is approved.

Types in Feasibility: As with the system request, each organization has its own process and format for the feasibility analysis, but most include techniques to assess three areas:

- Technical Feasibility,

- Economic Feasibility, and

- Organizational Feasibility

Technical Feasibility?

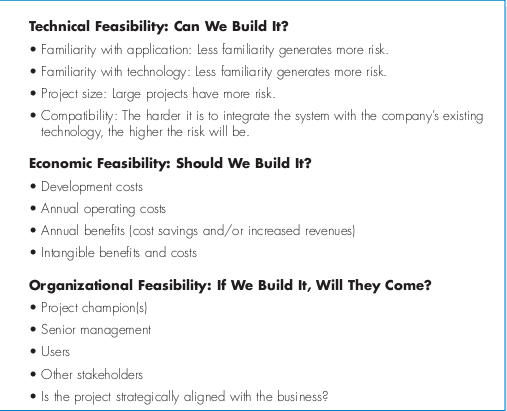

- Technical Feasibility: Can We Build It?

- Familiarity with application: Less familiarity generates more risk.

- Familiarity with technology: Less familiarity generates more risk.

- Project size: Large projects have more risk.

- Compatibility: The harder it is to integrate the system with the company’s existing technology, the higher the risk will be.

Economic Feasibility

- Economic Feasibility: Should We Build It?

- Development costs

- Annual operating costs

- Annual benefits (cost savings and/or increased revenues)

- Intangible benefits and costs

Organizational Feasibility

- Organizational Feasibility: If We Build It, Will They Come?

- Project champion(s)

- Senior management

- Users

- Other stakeholders

- Is the project strategically aligned with the business?

Technical Feasibility

- The first technique in the feasibility analysis is to assess the technical feasibility of the project, the extent to which the system can be successfully designed, developed, and installed by the IT group.

- Technical feasibility analysis is, in essence, a technical risk analysis that strives to answer the question: “ Can we build it?”

Familiarity with the application

- First and foremost is the users’ and analysts’ familiarity with the application.

- When analysts are unfamiliar with the business application area, they have a greater chance of misunderstanding the users or missing opportunities for improvement.

- The risks increase dramatically when the users themselves are less familiar with an application.

- When a system will use technology that has not been used before within the organization, there is a greater chance that problems and delays will occur because of the need to learn how to use the technology.

- Risk increases dramatically when the technology itself is new.

Project size

- Project size is an important consideration, whether measured as the number of people on the development team, the length of time it will take to complete the project, or the number of distinct features in the system.

- Larger projects present more risk, because they are more complicated to manage and because there is a greater chance that some important system requirements will be overlooked or misunderstood.

Compatibility

- Systems rarely are built in a vacuum—they are built in organizations that have numerous systems already in place.

- New technology and applications need to be able to integrate with the existing environment for many reasons.

- They may rely on data from existing systems, they may produce data that feed other applications, and they may have to use the company’s existing communications infrastructure.

- A new system has little value if it does not use customer data found across the organization in existing sales systems, marketing applications, and customer service systems.

Economic Feasibility

- Economic feasibility analysis also called a cost–benefit analysis.

- This attempts to answer the question “Should we build the system?”

- Economic feasibility is determined by identifying costs and benefits associated with the system, assigning values to them, calculating future cash flows, and measuring the financial worthiness of the project.

- Keep in mind that organizations have limited capital resources and multiple projects will be competing for funding.

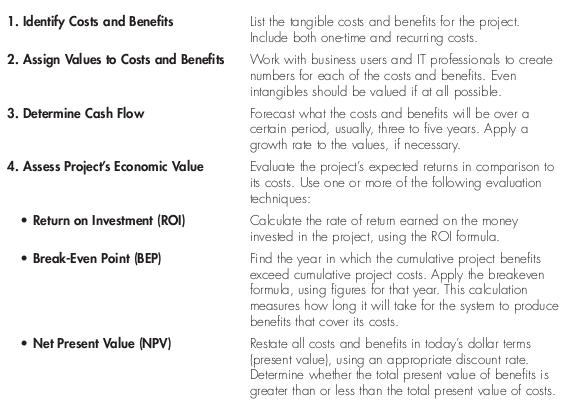

Steps to Conduct an Economic Feasibility Analysis

- Identify Costs and Benefits

- List the tangible costs and benefits for the project.

- Include both one-time and recurring costs.

- Assign Values to Costs and Benefits

- Work with business users and IT professionals to create numbers for each of the costs and benefits.

- Even intangibles should be valued if at all possible.

- Determine Cash Flow

- Forecast what the costs and benefits will be over a certain period, usually, three to five years.

- Apply a growth rate to the values, if necessary.

- Assess Project’s Economic Value

- Evaluate the project’s expected returns in comparison to its costs.

- Use one or more of the following evaluation techniques:

- Determine Cash Flow

- Forecast what the costs and benefits will be over a certain period, usually, three to five years.

- Apply a growth rate to the values, if necessary.

- Assess Project’s Economic Value

- Evaluate the project’s expected returns in comparison to its costs.

- Use one or more of the following evaluation techniques:

Assess Project’s Economic Value

- Return on Investment (ROI)

- Calculate the rate of return earned on the money invested in the project, using the ROI formula.

- Break-Even Point (BEP)

- Find the year in which the cumulative project benefits exceed cumulative project costs.

- Apply the breakeven formula, using figures for that year.

- This calculation measures how long it will take for the system to produce benefits that cover its costs.

iii. Net Present Value (NPV)

- Restate all costs and benefits in today’s dollar terms(present value), using an appropriate discount rate.

- Determine whether the total present value of benefits is greater than or less than the total present value of costs.

Identify Costs and Benefits

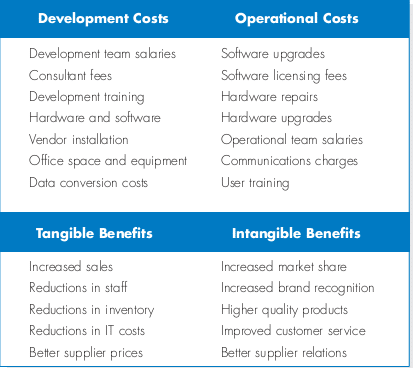

- The systems analyst’s first task when developing an economic feasibility analysis is to identify the kinds of costs and benefits the system will have and list them.

- The costs and benefits can be broken down into four categories:

- (1) Development Costs,

- (2) Operational Costs,

- (3) Tangible Benefits, and

- (4) Intangible Benefits.

Development costs

- Development costs are those tangible expenses that are incurred during the creation of the system, such as salaries for the project team, hardware and software expenses, consultant fees, training, and office space and equipment.

- Development costs are usually thought of as one-time costs.

Operational costs

- Operational costs are those tangible costs that are required to operate the system, such as the salaries for operations staff, software licensing fees, equipment upgrades, and communications charges.

- Operational costs are usually thought of as ongoing costs

Tangible benefits

- Tangible benefits include revenue that the system enables the organization to collect, such as increased sales.

Tangible benefits include revenue that the system enables the organization to collect, such as increased sales.

Assign Values to Costs and Benefits

- Once the types of costs and benefits have been identified, the analyst needs to assign specific BDT values to them.

- This may seem impossible—How can someone quantify costs and benefits that haven’t happened yet? And how can those predictions be realistic?

- The most effective strategy for estimating costs and benefits is to rely on the people who have the best understanding of them.

Cash Flow Analysis and Measures

- IT projects commonly involve an initial investment that produces a stream of benefits over time, along with some ongoing support costs.

- Cash flows, both inflows and outflows, are estimated over some future period.

- In this simple example, a system is developed in Year 0 (the current year) costing $100,000. Once the system is operational, benefits and on-going costs are projected over three years.

Return on Investment(ROI)

- The return on investment (ROI) is a calculation that measures the average rate of return earned on the money invested in the project.

- ROI is a simple calculation that divides the project’s net benefits (total benefits – total costs) by the total costs.

A high ROI suggests that the project’s benefits far outweigh the project’s cost, although exactly what constitutes a “high” ROI is unclear.

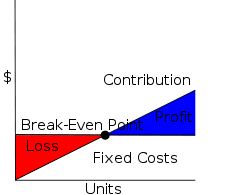

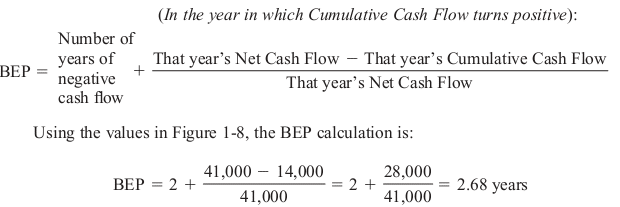

Break-Even Point

- The break-even point (also called the payback method ) is defined as the number of years it takes a firm to recover its original investment in the project from net cash flows.

- In this example, the project’s cumulative cash flow figure becomes positive during Year 3, so the initial investment is “paid back” over two years plus some fraction of the year 3.

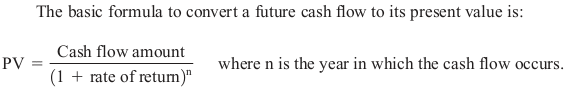

Discounted Cash Flow Technique

- Discounted cash flows are used to compare the present value of all cash inflows and outflows for the project in today’s BDT terms.

- A BDT received in the future is worth less than a BDT received today, since you forgo that potential return.

Discounted Cash Flow Projection

Net Present Value (NPV)

- The NPV is simply the difference between the total present value of the benefits and the total present value of the costs.

- As long as the NPV is greater than zero, the project is considered economically acceptable.

Net Present Value (NPV)

- Unfortunately for this project, the NPV is less than zero, indicating that for a required rate of return of 10%, this project should not be accepted.

- The required rate of return would have to be something less than 6.65% before this project returns a positive NPV.

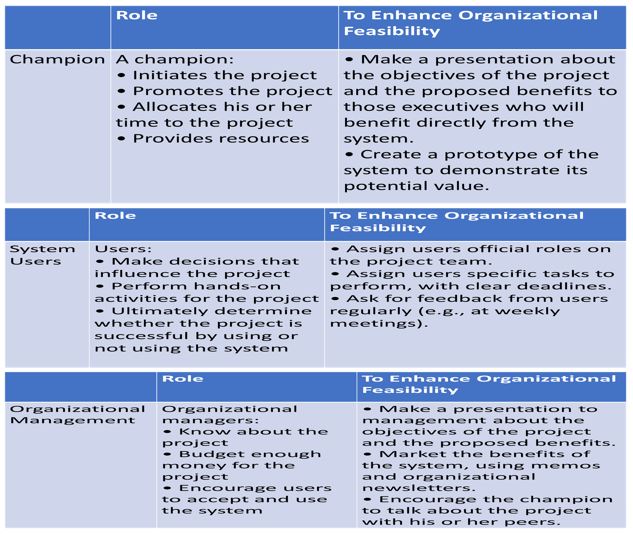

Organizational Feasibility

- The final technique used for feasibility analysis is to assess the organizational feasibility of the system: how well the system ultimately will be accepted by its users and incorporated into the ongoing operations of the organization.

- One way to assess the organizational feasibility of the project is to understand how well the goals of the project align with business objectives.

- A second way to assess organizational feasibility is to conduct a stakeholder analysis.

- A stakeholder is a person, group, or organization that can affect (or can be affected by) a new system.

- The most important stakeholders in the introduction of a new system are the project champion, system users, and organizational management.

Try yourself

- Think about the idea that you developed to improve your university course enrollment process.

QUESTIONS :

- List three things that influence the technical feasibility of the system.

- List three things that influence the economic feasibility of the system.

- List three things that influence the organizational feasibility of the system.

- How can you learn more about the issues that affect the three kinds of feasibility?

0 Comments